Floor Mirror Wholesale Isn’t About “Pretty” — It’s About What Survives the Truck, the Store, and the Return Desk

I’ll be honest: floor mirrors are one of the easiest “yes” decisions—until they’re not.

A well-designed full-length mirror can upgrade a whole department: it lifts the room set, sells the lifestyle, and quietly increases basket size. But floor mirrors also carry a special kind of risk: one cracked corner, one warped frame, one “looks different than the sample,” and your margin gets eaten by returns, replacements, and markdowns.

And returns are not a small line item. The National Retail Federation reported $743B in total merchandise returns in 2023—14.5% of sales.

Meanwhile, Deloitte’s Global Powers of Retailing shows top retailers averaging 4.3% net profit margin—meaning there isn’t much cushion for preventable damage and inconsistency.

So if you’re selling floor mirror wholesale, here’s what I want from you as a U.S. home retail buyer:

Not a vibe.

Not a mood board.

A reorder-ready system that protects the “profit model” of every mirror SKU.

Why floor mirror wholesale is a “packaging category” disguised as décor

Floor mirrors are large, flat, and vulnerable—exactly the kind of parcel profile that gets punished in real handling environments. Industry packaging writers have long pointed out that large, flat packages (mirrors, panels) are more prone to face impacts and damage, and long packages can suffer “bridging” on conveyors.

That’s why, in my head, floor mirrors aren’t only a product decision—they’re a transit decision.

If your wholesale offer doesn’t include a serious packaging standard and test mindset, you’re not really offering a sellable SKU. You’re offering a future claims process.

The buyer’s floor mirror wholesale checklist (what gets a PO faster)

When I’m building an assortment, the mirrors that win are the ones that reduce uncertainty. Here’s the practical checklist I use:

Master reference locked: finish + color + weld/edge details + backing + hardware standard

QC checkpoints that match failure modes: not generic “inspection,” but mirror-specific controls

Packaging spec that can be audited: corner protection, face protection, bracing, drop-risk thinking

Repeatable lead time: the timeline you can hit again, not just once

Reorder logic: MOQ that doesn’t trap inventory (and doesn’t punish replenishment)

Profit model support: landed-cost clarity + damage allowance + promo reality

If you can walk me through this in plain English, you’ve already separated yourself from 80% of the market.

“Profit model for SKUs” — the floor mirror edition

Yes, I’m still running the math. Always.

In floor mirror wholesale, the SKU profit model lives or dies on three hidden variables:

Landed cost volatility (packaging + handling + freight reality)

Damage rate (how many units become margin leaks)

Sell-through confidence (how fast we can reorder without quality drift)

That’s why the wholesale price alone doesn’t impress me. I’m looking for a merchant profit plan that says:

Here’s how this mirror stays consistent across batches

Here’s how it arrives intact

Here’s how you help me keep margin when real life happens

Because “thin-margin retail” is a fact, not a mindset.

What “reorder-ready” looks like for floor mirrors (no fluff)

Reorder-ready mirrors have a specific feel—not just visually, but operationally:

Frame integrity you can repeat: stable joins, stable finish, stable backing

Hardware that behaves: hang points aligned, stands stable, anti-tip thinking (where applicable)

Surface consistency: antiqued effects, coating, patina—beautiful and repeatable

Packaging engineered, not improvised: corners protected like they matter (because they do)

This is also where trend value meets manufacturing reality. Design media has been calling mirrors “signature pieces” and a consistent part of current interiors, including antiqued and statement mirror looks.

When mirrors become a focal point, customers notice imperfections faster—and returns get easier.

The quiet job buyers need suppliers to do: “value translation”

Here’s the part most factories don’t see:

Buyers speak in outcomes.

Factories speak in processes.

Profit lives in the translation.

A strong wholesale partner “translates” a buyer’s need—margin safety + brand consistency + fast replenishment—into execution details:

the right materials and surface treatment for repeatability

the right process notes so production doesn’t drift

the right QC points so defects don’t ship

the right packaging so freight doesn’t erase profit

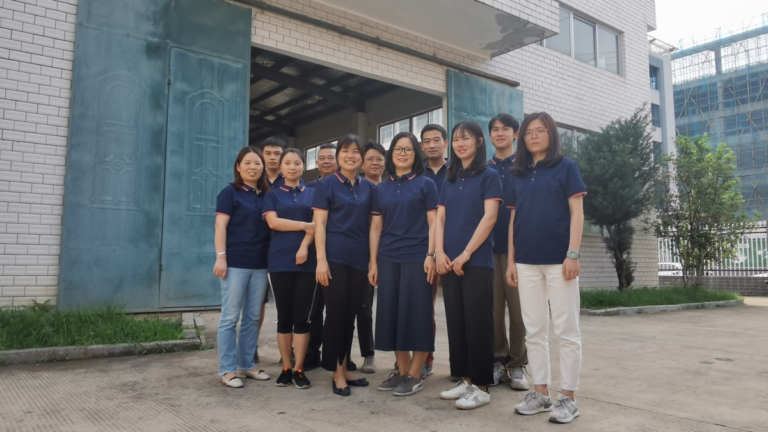

That’s essentially what Teruier is built to do: act as the coordination layer that protects your results—turning trend intent into a buildable, reorderable mirror SKU.

And our edge isn’t abstract. It comes from a craft manufacturing ecosystem where artisans, materials, and process know-how are concentrated and responsive—so problems get solved at the source, not argued about after the container lands.

Packaging standards buyers trust (the words that signal you’re serious)

If you want instant credibility in floor mirror wholesale, talk like someone who understands shipping reality.

Two signals matter:

ISTA mindset: ISTA test procedures exist to evaluate transport packaging performance and compare packaging designs.

Hazard awareness: large flat parcels behave differently in conveyor networks and are more impact-prone.

You don’t need to drown me in lab jargon. But I do want to hear:

“We design packaging around how mirrors actually get handled.”

That one sentence lowers my perceived risk more than a 3% discount ever will.

What I’d ask you in a 20-minute buyer call

If you sell floor mirror wholesale, be ready for these questions:

What’s your damage-prevention approach for large flat parcels?

Which QC checkpoints catch the top 3 mirror defects before packing?

How do you lock the master reference so batch 2 matches the sample?

What’s your best lead time you can repeat in peak season?

What’s your reorder plan (MOQ + capacity + finish stability)?

How do you protect my profit model when returns and damage are inevitable in retail?

If you answer these cleanly, you’re not pitching mirrors anymore—you’re pitching certainty.

The bottom line buyers care about

Floor mirrors sell style.

But floor mirror wholesale succeeds on systems: packaging, QC, repeatability, and a profit model that survives returns and transit.

If your wholesale offer helps me reorder with confidence—without quality drift, without surprise damage, without margin leaks—you become the supplier I keep.

Because in modern retail, the real “best seller” isn’t the prettiest mirror.

It’s the mirror that arrives intact, sells clean, and reorders without drama.